- Blog

- Detecting Location Spoofing Used to Evade Russian Sanctions

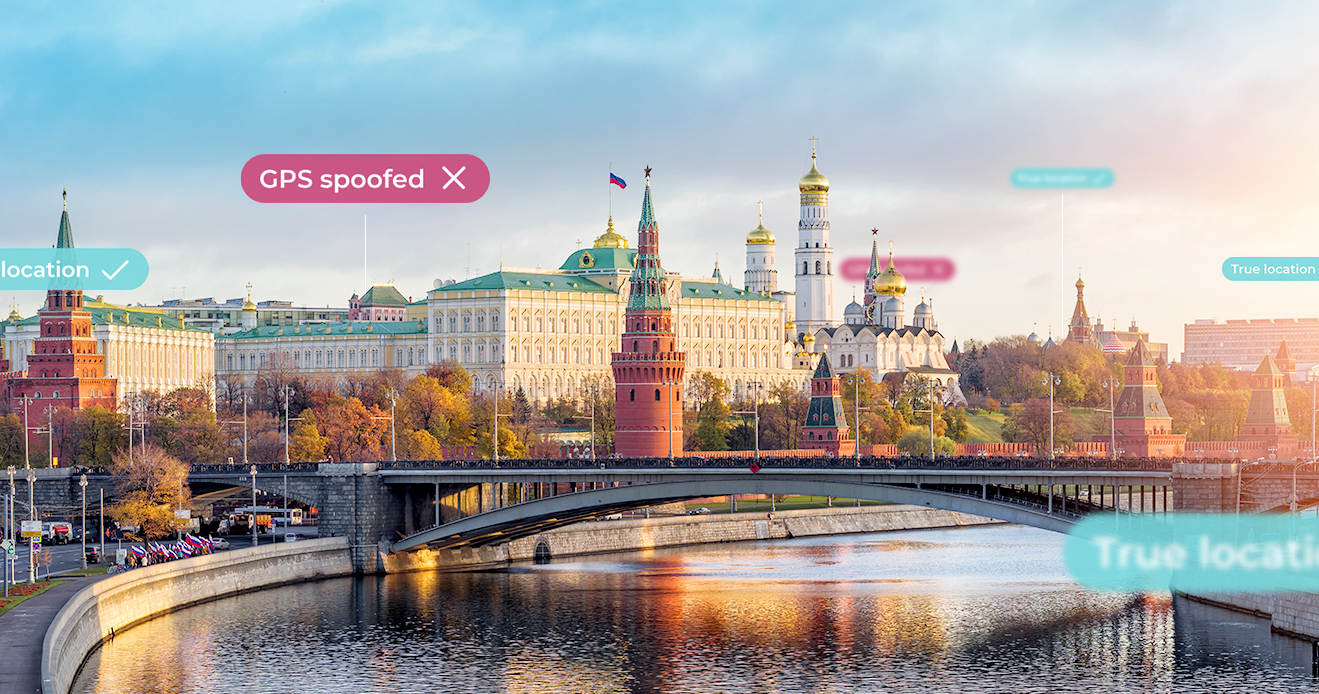

Detecting Location Spoofing Used to Evade Russian Sanctions

The Essentials for Detecting Users Spoofing Their Location

Subscribe to the Incognia Newsletter

Fintech, Banks and Cryptocurrency companies received an update this week from the US Treasury to be on the lookout for attempts to evade the economic sanctions and other financial restrictions being applied in response to Russia’s invasion of Ukraine.

As reported today in the WSJ U.S. Warns Banks, Crypto Firms Against Potential Efforts to Evade Russian Sanctions, the Financial Crimes Enforcement Network issued a FinCEN Alert on Monday providing red flag indicators that financial services companies should be on the lookout for indicating a possible evasion of sanctions.

Highlighted in the FinCEN Alert FIN-2022-Alert001 is a red flag indicator to be on high alert for financial transactions using IP addresses in Russia, Belarus and other jurisdictions with AML/CFT/CP deficiencies, or using IP addresses previously flagged as suspicious.

The reality is that bad actors have at their disposal easily accessible tools to obscure their true location. IP addresses and GPS are easily spoofed and are inadequate in determining a user’s true location.

Location spoofing has been increasing across the board, not just in financial services but also for gaming, social networks, logistics and delivery.

To understand more about how to detect location spoofing please access our resources including 5 ways Fraudsters Routinely Spoof Location and ebook: Location Spoofing.

Incognia location identity technology works with native mobile apps and on-device sensors to provide highly accurate risk assessments based on device intelligence and location behavior, and is highly effective at detecting location spoofing.

Please contact us for assistance to stop fraudsters and bad actors concealing their true location.