Recent posts

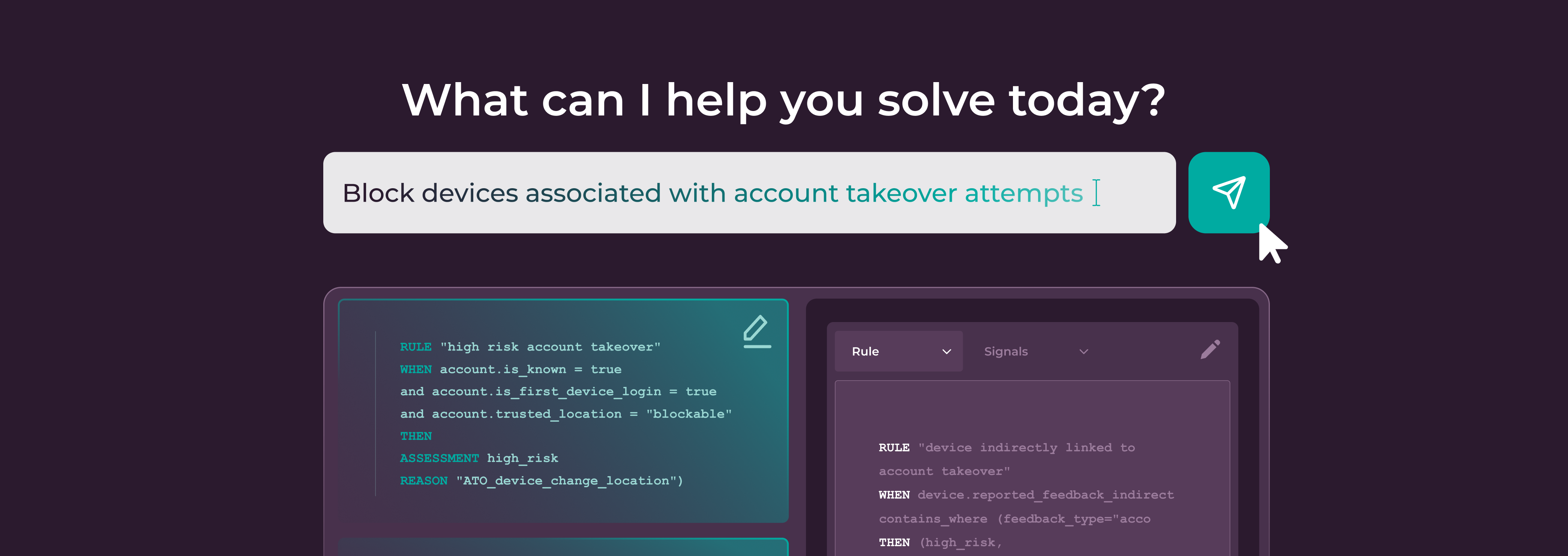

AI Rule Builder: The Next Innovation in How Fraud Rules Get Built

Discover how Incognia's AI Rule Builder revolutionizes...

Why Incognia’s AI-Powered Browser ID is the Next Standard for Web Identity

Discover how Incognia's AI-powered Browser ID redefines web...

Incognia’s Network Graph: Persistent Device ID for Faster Fraud Investigations

Persistent and tamper-resistant device IDs in Incognia's...

How Marketplaces Can Outsmart Seller Fraud in 2026

Discover how to combat sophisticated seller fraud in 2026...

Episode 4: How Rapido Balances Driver Supply with Fighting Fraud

Learn how Rapido balances driver supply and fraud...

How App Cloners are Becoming a One-Stop-Shop for Fraudsters

Take a deep dive into the rise of app cloners and what...