CASE STUDY

15M-User Neobank Authenticates 92% of Instant Payments Frictionlessly using Incognia’s Device & Location Intelligence

The bank partnered with Incognia to combat social engineering and payment fraud while keeping the experience frictionless for legitimate customers.

“Incognia goes beyond device validation to help us recognize the user in the physical world. This layer of context is critical for combating social engineering in real-time payments—like Pix—without compromising the experience for the customers who trust us.”

Invisible Security fully integrated into the instant payment flow.

92%

of transactions classified as "Low Risk," enabling a frictionless flow.

Significant Cost Reduction regarding secondary authentication (OTP/Biometrics) and manual reviews.

0.02%

of transactions classified as "High Risk," blocking threats with high precision.

CONTEXT

What is "Pix"?

Pix is Brazil’s instant payment ecosystem. It allows 24/7 transfers in seconds and has been adopted by over 70% of the population, effectively replacing cash.

Because of its speed and ubiquity, Pix is a prime target for fraudsters. Funds move instantly and are difficult to recover. For banks, the challenge is authorizing these instant transactions without slowing down the user.

Global Equivalents:

-

🇺🇸 United States: Similar to FedNow, RTP, or Zelle.

-

🇬🇧 United Kingdom: Similar to Faster Payments (FPS).

THE CHALLENGE

Real-Time Fraud &

Social Engineering

The dominance of instant payments highlighted the primary dilemma facing modern financial institutions: balancing robust security with a seamless user experience.

The Fraud Vectors

The challenge with instant payments goes beyond traditional account takeovers. Banks face sophisticated attacks, including social engineering and user manipulation (authorized push payment fraud), where traditional digital signals often fail to detect that the transaction, while technically "authorized," is actually fraudulent.

.png)

The Friction Dilemma

Implementing excessive security barriers to combat fraud often hurts legitimate customers. Traditional authentication methods (facial biometrics, OTPs) create high friction even for low-risk operations, negatively impacting the user journey. The goal was to be agile—using data to anticipate risk and protect the client without them ever noticing the shield.

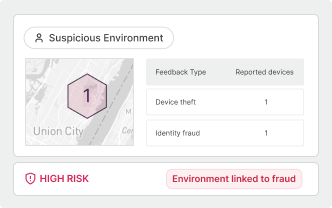

User & Behavior Recognition

Incognia constructs a robust identity by linking digital behavior to the physical world. This allows the bank to differentiate a legitimate user’s routine from a fraudster’s, using historical behavior to provide accurate risk assessments.

.png)

Anomaly & Integrity Detection

The system detects subtle risk patterns, such as a transfer originating from an unusual location, the use of emulators, or a recently factory-reset device.

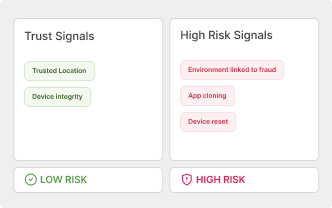

Dynamic Friction

The solution enables adaptive security. Transactions made from known devices in habitual locations (like the user's home) flow without interruption. Friction is introduced only when there are clear signals of risk or device integrity compromise.

Intelligent Decision Matrix

The solution allowed the Neobank to implement granular rules. For example, limiting transaction values for new devices or operations outside trusted locations.

-

Example: A low-value payment (e.g., under $50) with a location fingerprint match is automatically classified as low risk, bypassing step-up authentication. "Location is not just a dot on a map; it is a context of trust that distinguishes a secure experience from fraud in disguise."

.png)

By combining device integrity with behavioral history, the Neobank moved to a model of situational intelligence, preventing fraud with surgical precision while respecting the customer's journey.