- Newsroom

- Incognia Announces Fintech Mobile App Study [Onboarding Friction Index]

Incognia Announces Fintech Mobile App Study [Onboarding Friction Index]

Incognia Fintech Mobile App Study Gives Top Ranking to Chime, Robinhood and Credit Sesame for Lowest Mobile Onboarding Friction

Subscribe to Incognia’s content

Palo Alto, CA - February 9, 2021 - Mobile identity company Incognia today announced the publication of their inaugural Mobile App Report in 2021, the first in a series, that includes results from their recent Mobile App Friction Study on Fintech Onboarding. The study was conducted to provide banks, fintechs and neobanks with an analysis of the state of friction in onboarding new customers to fintech mobile apps and to raise visibility to the friction created by security and fraud controls. Mobile apps in the mobile banking, investing/trading and other financial services categories were reviewed, and included Chime, Dave, GoBank, MoneyLion, Simple, Acorns, Robinhood, Wealthfront, Credit Sesame and Earnin.

The transformation of how customers choose to bank and make payments reflects one of the biggest changes in customer behavior resulting from the global pandemic. The Incognia Mobile App Report focuses on the onboarding process comparing ten of the most popular fintech apps. The report analyzes the onboarding process for customers opening a new account, considering application time, requested information, number of screens, fields and clicks required of the new user.

“Nearly 2.4 billion people use their smartphones for financial services, which has only increased during the COVID-19 pandemic. As new users look to adopt mobile banking, mobile investing and financial services, the ease or difficulty of onboarding new customers becomes a differentiator for apps and a factor in overall customer experience and retention,” said André Ferraz, founder and CEO of Incognia. “Our Mobile Onboarding Friction Index provides a measure of which mobile apps provide the least amount of friction for new user onboarding.”

For each app, the Mobile App Report examines and quantifies factors that contribute to friction in the user onboarding experience. Results from the Mobile App Friction Study indicate that Chime, Robinhood and Credit Sesame had the lowest Mobile Onboarding Friction Index scores, reflecting the fastest and most streamlined experience for new users.

The data gathered during the analysis of each app was used to create the Incognia Mobile Onboarding Friction Index. The lower the Index, the better the onboarding experience. The Mobile App Onboarding Friction Index accounts for the following factors:

- Application time: The time required to submit a new account application via the mobile app, including the sign up time from the first registration screen to the last, when the application is complete and submitted. The application sign up time for each app is shown as the average of the time recorded for onboarding on both operating systems, Android and iOS.

- Screens: The number of screens that are presented during the onboarding process was recorded for each app, including all the screens from the beginning until the end of completing a new account application.

- Clicks: The number of clicks required for submitting a new account application were counted and recorded from the first until the last screen of onboarding. If any screen has the need for multiple clicks, all were counted.

- Fields: All fields and checkboxes that were required to be entered as part of the onboarding process were counted and included in the count of required fields.

- Information requested: The specific personal information items requested as part of the new account application were recorded.

The Incognia Mobile App Friction Study found that Chime, Robinhood and Credit Sesame exhibited the lowest Onboarding Friction Index across the three categories of mobile banking, investment/trading and other financial services app categories. Key data points from the report include:

- 6 minutes: Average time to complete new account onboarding via the mobile app. Chime and Credit Sesame tied for the fastest application time of 4.5 minutes.

- 14 screens: Average number of screens presented during mobile app onboarding. Credit Sesame required the fewest number of screens at 8 total.

- 29 clicks: Average number of clicks required during mobile app onboarding. Robinhood required the least amount of clicks to create an account at 16 total.

- 16 fields: Average number of fields required during mobile app onboarding. Credit Sesame and Earnin tied for the fewest number of required fields at 9 total.

Download the complete Incognia Mobile App Report: Fintech Onboarding Friction Index here: https://www.incognia.com/resources/fintech-onboarding-friction-index

About Incognia

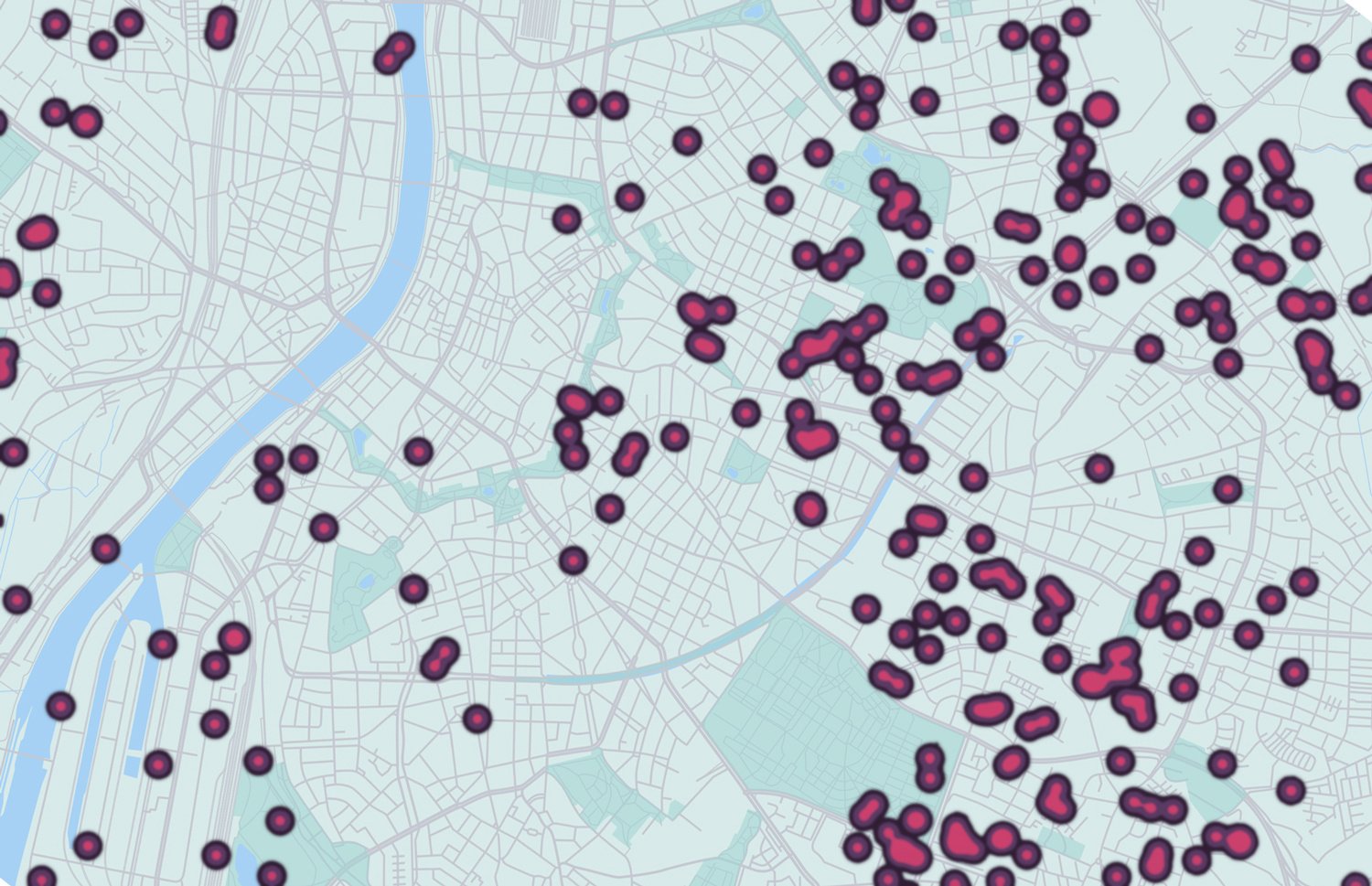

Incognia is a mobile identity company that enables advanced fraud prevention for banks, fintech and mcommerce companies. Using location behavioral biometrics Incognia offers frictionless identity verification and authentication. Incognia’s location technology uses network signals and on-device sensors to deliver highly precise location information. By building an anonymous location behavioral pattern, unique for each user, Incognia creates a private digital identity for account security.

Incognia is privately held and headquartered in Palo Alto, California with teams in New York and Brazil.

Stay connected and follow Incognia on Twitter and LinkedIn.

Media Contact

Madeline Kalicka, Karbo Communications for Incognia

(240) 427-8961

incognia@karbocom.com