"Incognia has replaced our internal device id with a hyper-robust and reinstall-proof one. Their device intelligence technology has given us a new layer of emulator detection and, along with Incognia's device id, has significantly impacted chargeback and cancellation fraud reduction.”

Food delivery app with 50M+ orders per month, 50M+ total users, over 200K courier accounts and 89% of users share location

A leading food delivery company in globally was facing three main challenges relating to courier behavior:

The app noticed that a growing number of couriers were using GPS spoofing applications. By generating fake GPS data, the couriers were able to defraud the platform by charging for orders they didn’t deliver, reporting longer rides, and accepting orders from busy neighborhoods, even if they were not nearby.

Additionally, the fraud team began receiving reports of bad actors impersonating delivery drivers to defraud customers. These fake couriers were executing a social engineering scam that involved using an external mobile POS machine to steal large sums of money from unsuspecting users. They would claim that the original transaction didn’t go through and that they needed to swipe the customer’s card again upon delivery.

To deal with this problem, the app had been blocking the accounts associated with the occurring fraud, rather than the devices that the fraud was being committed with. This allowed the fraudsters to continue the scam with the same device by creating a new account or renting one from another courier. To solve this problem the app needed a way to re-recognize the devices used by bad acting couriers to prevent them from creating new accounts.

Before partnering with Incognia, the food delivery app tried to address this fraud problem by creating its own device fingerprinting solution. Using rules, the company attempted to identify behavioral anomalies by flagging abnormally expensive rides and then analyzing the GPS coordinates to determine the feasibility of each delivery. Unfortunately, GPS coordinates were not precise enough to generate conclusive results. The team wanted a proactive solution that could deliver a real-time signal that could detect fraud before it occurred.

To solve these challenges, the delivery app needed to implement a solution that could 1) detect GPS spoofing and 2) flag high risk couriers based on location, account and device information to stop repeat offenders. The company chose to leverage two features of Incognia’s location identity solution at different moments of the user journey. It decided to call the Incognia API at login, to check the device against the Incognia watchlist and re-recognize courier devices, and just before a courier accepts a delivery in order to detect GPS spoofing.

After integrating the Incognia SDK and risk scoring APIs, Incognia analyzed one month of location data from 1.3M couriers. Incognia determined that approximately 3% of couriers accessed at least two accounts and ~1% of all couriers were spoofing their location. After implementing Incognia, the delivery app saw a significant reduction in gps spoofing and chargebacks associated with mPOS fraud. Incognia’s location accuracy and device fingerprint ensured that bad actors were identified and the false positive rate remained low, preventing fraud before it happened.

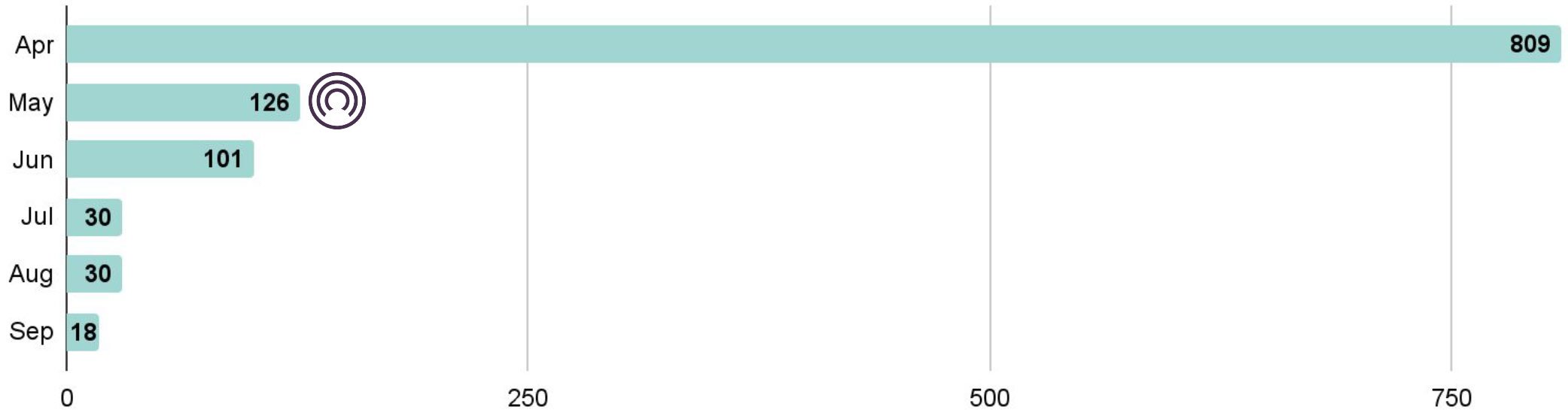

During the one month testing phase, Incognia reduced fraudulent activity by 53%. Today, after the full Incognia implementation in March 2022, and several months of production results, Incognia has delivered a 97.5% reduction in social engineering scams, like mPOS fraud, a 90% reduction in ATO fraud, and an 84% reduction in fraud losses.

One of our specialists will be glad to meet you and go over Incognia's capabilities.

To help us personalize our conversation for your business, please fill out the following form.