"Incognia's solution has helped us prevent account takeover theft fraud in our application generating savings of millions. It has also helped us reduce costs with easy biometrics, and reduce friction in our customers' security rules.”

"Incognia is helping our company identify systematic fraudulent behavior by providing a an effective device ID solution. They have a solid product and top notch post-sales team."

"With Incognia, we've changed our fraud (Chargeback and Promo Abuse) scenario. Incognia helped us to improve our solutions to identify bad actors' in-app journeys.”

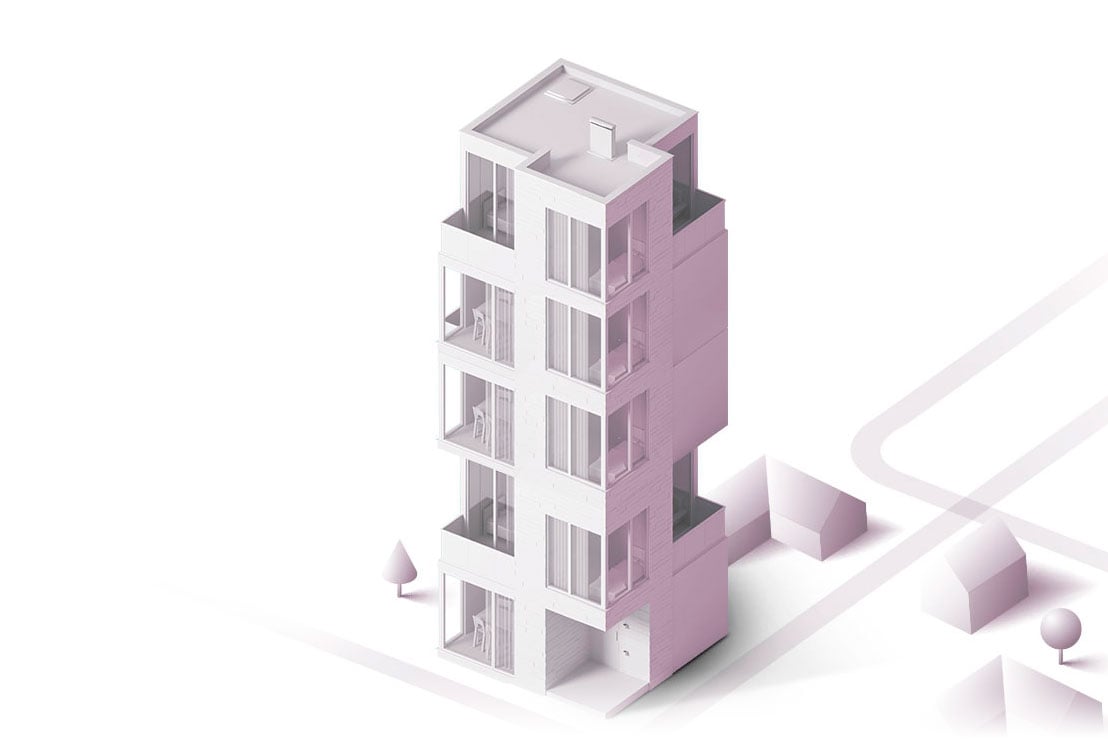

Incognia’s customized, AI-driven approach to device recognition enables you to recognize more users, prevent fraud and provide a better user experience. Our novel model-based approach evolves as your user population changes, resulting in a device intelligence technology that is both stable and adaptable to change.

Incognia matches the new user’s address or the existing user's historical location behavior to the device's current location to assess risk and deliver a risk score.

Incognia checks the user’s device for tampering, location spoofing, emulation and against any customized watchlists created.

Validate trusted users through their devices. Incognia offers a device intelligence solution that recognizes trusted devices in real-time. Incognia leverages device-level information and device behavior to add trust to onboarding, login and transactions.

To help us personalize our conversation for your business, please fill out the following form.