- Blog

- Managing Friction and User Verification: Remembering the User’s Perspective

Managing Friction and User Verification: Remembering the User’s Perspective

Safeguarding online platforms against fraud without compromising user experience can be like walking a tightrope. In this post, we explore the delicate equilibrium between robust fraud prevention mechanisms and maintaining a seamless, user-friendly interface. By adopting strategies like user verification, strategic communication, leveraging user experience stakeholders' insights, and prioritizing low-friction solutions, platforms can protect their integrity whilst fostering a positive relationship with their users.

Subscribe to Incognia’s content

For those who prefer listening over reading, we've provided an audio transcription player below, allowing you to enjoy this post through your speakers or headphones.

When you’re a fraud prevention expert, it’s normal to spend your day in the weeds. Managing support tickets, investigating customer complaints, reviewing suspected cases of fraud, managing data intelligence and decisioning, interacting with vendors, investigating new fraud threats and solutions—this is a fraud fighter’s bread and butter, but sometimes, we can lose the forest for the trees.

When you spend your professional life on the bleeding edge of fraud prevention, it can be easy to forget that not everyone comes to the problem with the same knowledge you have.

The group least likely to have this in-depth knowledge is exactly the group you most want to protect: your good users. Verification checks and fraud prevention measures that may seem like common sense to you might look like unnecessary hurdles to your user base, and that effect is only worsened if you don’t communicate why certain features are in place.

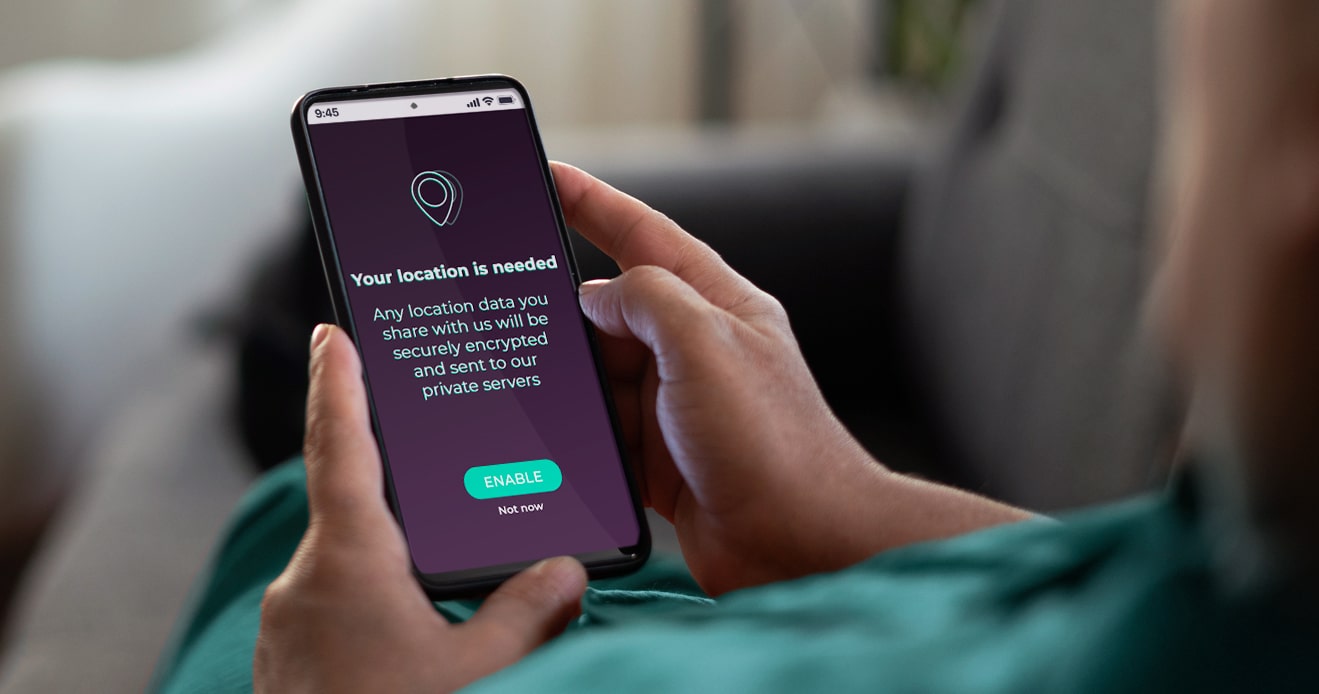

User buy-in is crucial for effective fraud prevention. If your users decide your fraud prevention measures are too much friction, they’ll just abandon the user journey, and if that happens, the platform can’t sustain itself no matter how good you are at stopping bad actors. User verification is one of the best ways to protect platform integrity, but it can also be one of the most frustrating steps for a new user. Remembering the average user’s perspective when implementing new features and verification checks can help foster a healthier relationship between you and your user base.

Communication is key: users don’t know what fraud fighters know

It might seem obvious on the surface, but it can be easy to forget—many users aren’t familiar with the ins-and-outs of how fraud prevention works. On your side, you might see bad actors using automated email account creation bots and buying aged email addresses to bypass email verification. On the user’s side, they might only see a frustrating switch from the easy email signup to a more frictional phone number SMS code verification.

Communicating the purpose of certain features can be an excellent way to encourage user buy-in. Most people are alright with accepting a little extra friction if they understand how it’s being used to protect them and their experience with the platform.

In the “Scam Stopper: Seller/Buyer Verification on P2P Marketplaces,” webinar hosted by Incognia, Reverb’s Director of Trust & Safety, Holly Sandberg, talked about the importance of communicating with users:

“There’s a lot of communication. Think always about the user journey and how you're going to educate your users if you're introducing something like verification, and it's not something that you've done with your community before. Lots of communications around it. Lots of prompts. And why are we doing this within messaging and within the user journey? Extremely important so your users understand what's happening, and hopefully if you're doing it right, they understand that it's actually to their benefit and to the benefit of the platform.”

Talking to user experience stakeholders

Users aren’t the only experts on how users feel. The user experience stakeholders at your company can be an excellent resource to lean on when trying to get a gauge for the risk-benefit ratio of a new fraud prevention feature. They also have the benefit of not being as close to the fraud prevention side, meaning they can offer a zoomed-out perspective that might be hard to get from within your own team.

As Holly puts it,

“Their perspective, I've learned, particularly when it comes to how friction would impact the user experience and would impact growth, is really, really critical…They're going to understand the user experience probably better than anyone on my team could, because we live and breathe this all day, every day. So what might seem very sort of logical to us, like, ‘Oh, they'll know why we're doing that.’ …From my view, my teams should never be doing that because we are so close to it that it's difficult to sort of back up and get that view that maybe someone from marketing or PR or sales would have.”

Treating the process as a collaboration with other teams can help ensure you put out the messaging around new checks and features that will have the highest chance of success at resonating with your users.

Prioritizing passive signals and low-friction solutions

Some friction is inevitable, but in addition to communicating with users about why that friction is necessary, it’s also a smart strategy to minimize friction where you can.

Deploying friction strategically in a step-up verification flow can be an excellent way to ensure that the smallest number of users possible experience the full friction of a more vigorous verification process.

Joe Midtlyng, Director of Enterprise Accounts at Incognia, used Incognia’s solution as an example of this exact strategy:

“An intelligent verification flow is something we're ultimately all after here. Intelligent verification flows that can early identify in the most frictionless way possible good users and then identify, with signals, those that are risky or questionable, and then step them up to other verification methods. That way you can introduce the friction that's necessary. So from Incognia’s perspective, what we're seeing and how we're helping clients is using a modern device and location signal early in that verification flow or waterfall as a low friction way to identify those good users with high accuracy and then allow platforms to step up to additional verification methods.”

One of our case studies has shown that, on average, we identify 82% of user risk instantly using location, including 71% of trusted users that can be authenticated instantly, friction-free.

Ultimately, users and fraud prevention teams are on the same side, and they both want the same thing—for good users to have a seamless, safe experience on their platform of choice. When fraud teams take a step back and consider the user’s perspective, collaborate with other, user-centric teams, and keep an ear to the ground for ways to optimize friction, the user and fraud prevention relationship can be one of mutual understanding.