- Blog

- 4 strategies for mitigating fraud risks on your P2P marketplace

4 strategies for mitigating fraud risks on your P2P marketplace

Discover four robust strategies to mitigate fraud risks on your P2P marketplace.

Subscribe to Incognia’s content

Mitigating fraud risks within peer-to-peer (P2P) marketplace platforms is a basic necessity for maintaining trust with your users and delivering an enjoyable experience. But, considering the rapid clip at which threats evolve in this space, staying ahead of the curve can feel like running uphill. Luckily, there are strategies that marketplace stakeholders can employ to mitigate the risk of fraud on their platforms.

Key TakeAways

- Fraud on marketplaces undermines user trust in the platform, hurting retention and revenue

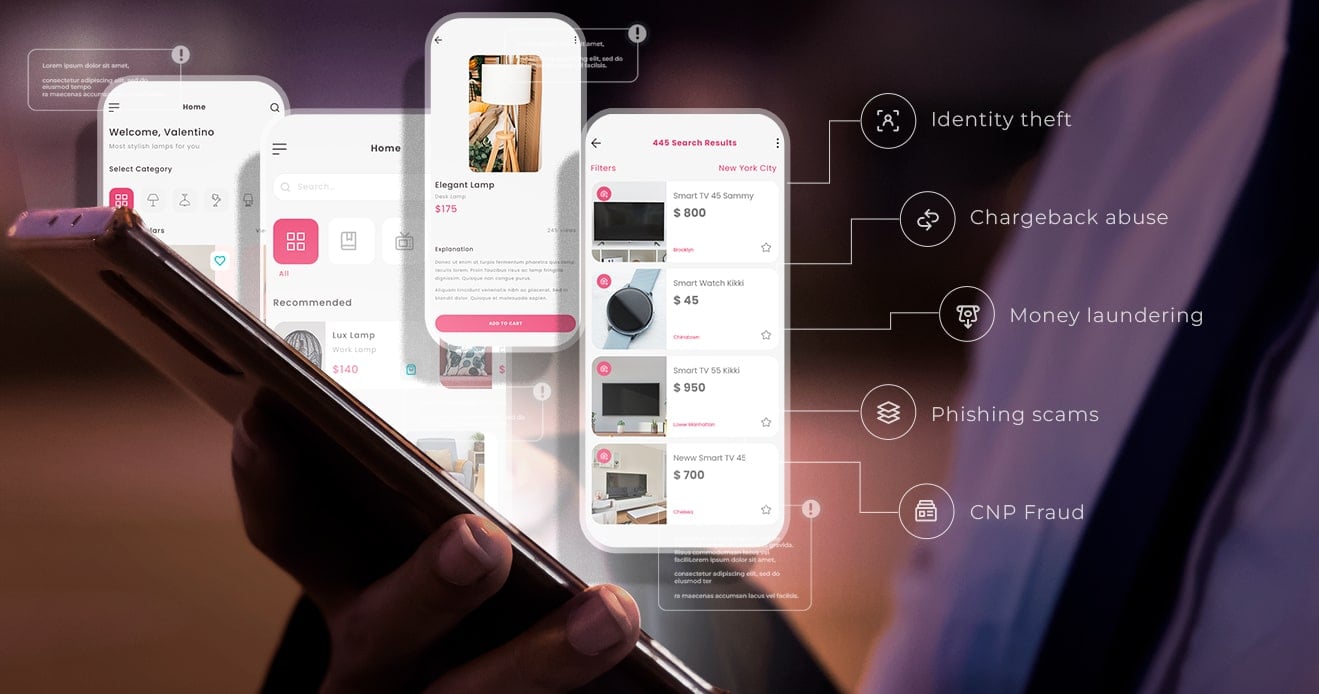

- Identity theft, CNP fraud, account takeovers, chargeback abuse, and more are just some examples of the types of fraud that an affect a P2P marketplace

- Adopting user verification and advanced fraud signals can help lower the risk of significant fraud threats on a platform

Different types of P2P marketplace fraud and their impact

The first step in mitigating fraud risks is understanding the different types of fraud and how they can affect your platform. Fraudsters use a variety of methods to exploit marketplaces, including identity theft, account takeover, social engineering, chargebacks, money laundering, phishing scams, and CNP (card-not-present) fraud.

1. Identity theft

Identity theft is a major risk for P2P marketplaces. Fraudsters can use compromised personal information to open accounts or access existing ones, and then leverage those resources for malicious purposes. This could include committing crimes or abuse under the victim’s name, socially engineering people in their contacts list by impersonating them, or purchasing goods using the victim’s financial information. Identity theft can have serious implications for your platform, including loss of customer trust, regulatory fines, and financial losses.

2. Chargeback abuse

Chargebacks occur when a customer disputes a payment or transaction after the fact. Filing a chargeback can be a legitimate way for a customer to recoup their money when they don’t receive their item or when authorized transactions are made on their account, but it becomes abuse when cardholders file chargebacks on legitimate transactions to get products and services for free. Card issuers often charge a fee to vendors whenever a chargeback is approved, so repeated abusive chargebacks can have significant financial consequences for a platform.

3. Money laundering

Money laundering is another serious threat for P2P marketplaces. Fraudsters may try to use your platform as a way to “clean” stolen or ill-gotten funds by having those funds transferred through multiple accounts within your system. This can have a devastating impact on your platform, including loss of customer trust and potential legal repercussions.

4. Phishing scams

Phishing scams involve fraudsters sending out fake emails or messages that appear to be from legitimate sources in an attempt to steal personal information. In the context of P2P marketplaces, this can mean targeting both buyers and sellers with fraudulent offers or requests for payment information.

5. CNP Fraud

Finally, CNP (card-not-present) fraud is a major risk that P2P marketplaces must be aware of. This occurs when a fraudster uses stolen or counterfeit card information to make fraudulent purchases. This type of fraud can have major financial implications for merchants, so it’s important to be proactive in detecting and preventing it.

Knowing the type of fraud risks involved in running an online marketplace is the first step in building an effective mitigation strategy. Fortunately, many fraud prevention solutions are effective against multiple different types of fraud.

4 strategies to help you mitigate fraud risk

Risk is an inevitable part of running an online platform, but that doesn’t mean that it has to be a runaway risk. The more risk management policies your platform can put in place, the better the outcomes for you and your users.

1. Analyze Your Existing System for Vulnerabilities

Fraud prevention often looks like a cat and mouse game between bad actors and fraud prevention teams: fraudsters are looking for holes in your security, so it’s your objective to find and patch them first.

Look at the data points you collect from customers and confirmed fraudsters and ask yourself if your current solutions are sufficient for verifying identities and validating transactions. Also, consider the processes you have in place for screening new accounts and detecting suspicious activity. If you aren’t seeing the return on investment you’d expect from your current stack, it may be time to look for greener pastures.

2. Implement Data Security Measures to Reduce Fraud Risk

Data security is essential for keeping fraud risks at bay. Make sure all customer data is encrypted and secure, and consider using two-factor, tamper and phishing-resistant authentication to further protect user accounts. Additionally, you should have robust processes in place for detecting suspicious activity and responding quickly to any breaches or attempted intrusions.

3. Adopt Know Your Customer/Anti-Money Laundering Procedures for Identity Verification

It's important to make sure you have KYC/AML procedures in place for verifying user identities. This will help prevent fraudsters from creating fake accounts and using stolen payment information to make purchases. Additionally, it’s always critical to stay up to date on international regulations related to money laundering and other financial crimes, as your platform may need to comply with these laws depending on the types of services you offer.

Travis Dawson of StockX describes the importance of this type of verification in this audiogram:

4. Leverage next-gen device intelligence and other advanced fraud detection tools

Next-generation device intelligence and other advanced fraud detection tools can be invaluable for mitigating fraud risk on P2P marketplaces. Location-based device intelligence technology can give fraud fighters extra context about suspicious accounts. By leveraging real-time address verification, geolocation spoofing detection, and location behavioral biometrics, platforms can detect suspicious activity, assess the risk level of users and transactions, and deny unauthorized account access.

Location data can also be used to provide powerful context to user identity. For example, by cross-referencing confirmed fraudster data with user behavior profiles, it's possible to detect suspicious patterns that may indicate fraudulent activities or repeat offenders. Additionally, incorporating location data into existing anti-fraud systems can help to reduce false positives, resulting in improved accuracy and efficiency of fraud detection processes.

Taking a holistic approach to security allows P2P marketplaces to effectively fight fraud, especially when leveraging location intelligence and other advanced tools as part of that strategy.

Incognia: location and device intelligence that embodies powerful risk management

Incognia is a powerful solution for P2P marketplaces that want to ensure a proactive approach to fraud prevention using sophisticated risk signals. Our proprietary fusion of device and location intelligence provides unparalleled accuracy and security, allowing you to identify fraudulent activity faster and more efficiently than ever before. With Incognia, you can be more confident in your new user verification and rest easy knowing that your good users will enjoy your platform in total security.

To learn more about how Incognia helps marketplace platforms secure their user experience, visit our marketplace place industry page here.