- Blog

- Using Seller Fraud Detection to Prevent Marketplace Scams

Using Seller Fraud Detection to Prevent Marketplace Scams

Protecting your marketplace: the power of fraud detection in ensuring customer trust and safety.

Subscribe to Incognia’s content

About 35% of online shoppers buy from marketplace platforms at least weekly, and with well over one hundred online marketplaces in existence, they’re spoiled for choice.

With so many options, competition between digital marketplaces is fierce, and any slight advantage or disadvantage could be the difference between loyal customers and people who click the back button after landing on your website.

Trust is a major factor that affects how likely people are to patronize (and re-patronize) your marketplace. If you struggle to keep your users’ trust by combating fraud and abuse, you’ll struggle to keep your users, too. That means buyer and seller fraud detection are vital pieces of any online marketplace’s success.

Fraud on marketplaces, its forms, and its impact

At the beginning of the digital age, the idea of sending strangers money over the Internet might’ve been unthinkable to most Americans. Today, people are more trusting of online marketplaces, but that trust is hard won—it takes a lot of faith in the integrity of a marketplace and its sellers to fork over cash for a product you can’t see in person first.

When marketplace transactions work out, they can be easy, convenient exchanges where everyone wins. The buyer gets their product, the seller turns a profit, and the marketplace takes a cut in sale percentage or ad revenue. But marketplace fraudsters upset the balance of these relationships by destroying consumer trust in the marketplace and driving away buyers.

Common fraud risks on P2P vs B2C marketplace platforms

Depending on the type of marketplace, fraud on a marketplace can take a few different forms. For example, on peer-to-peer (P2P) marketplaces like Craigslist or Facebook Marketplace, common fraud methods include fake listings, bait and switches, and social engineering.

In a bait and switch scheme, a seller might list one product but send the buyer another one, typically one that’s much lower in quality. An example of a social engineering scam would be a fraudster on a housing rental marketplace convincing users to divulge sensitive information like social security numbers, home addresses, and more.

Business to consumer (B2C) marketplaces often face problems like fake listings, fake reviews artificially inflating the rating of products and sellers, inaccurate descriptions, or products that never ship after the buyer pays for them.

In these cases, the marketplace itself may be on the hook to foot the bill if the consumer files a chargeback or requests a refund.

People seek out marketplace platforms for their ease and convenience. But getting scammed while trying to use one is anything but easy or convenient. And for many consumers, just one bad experience with a brand is enough to drive them away permanently.

Trust is a non-negotiable tenet of running a successful online marketplace business, so the stakes for preventing fraud are high.

How fraud detection risk signals can be leveraged to prevent marketplace fraud

After a consumer falls victim to fraud or a scam, they can report the other user involved and might see some justice in the form of that user’s account being banned or frozen.

But for the victim, the damage is already done. They may not be able to get back their funds or the personal information they gave to the fraudster. And no matter how well a marketplace responds in the aftermath of fraud, the consumer will still have that negative association with the brand in the future.

The best way to deal with merchant fraud is to prevent it from happening in the first place. That’s where risk signals come into play.

Using location intelligence and device integrity checks for risk assessment

Using risk assessments for users at onboarding can help fraud prevention stakeholders make more effective decisions about which accounts to block or otherwise limit in the interest of protecting the community.

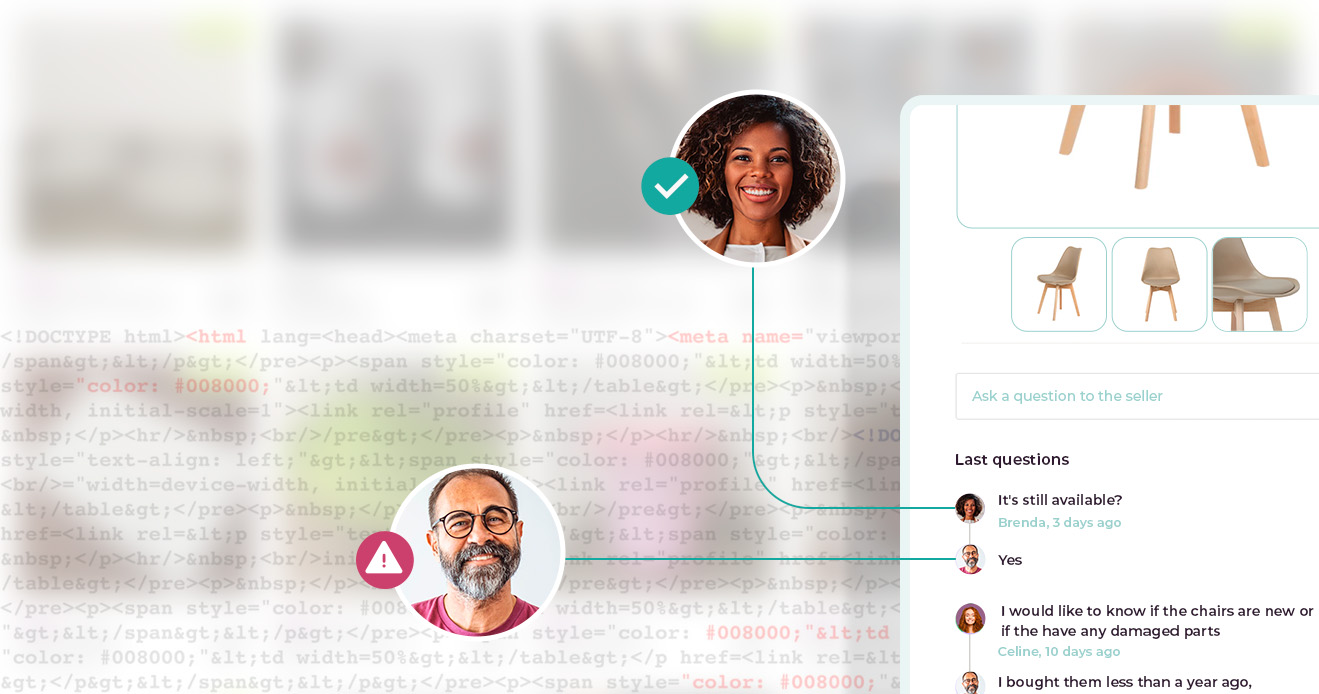

At Incognia, we use location-based device intelligence technology to assess fraud risk. For example, if a device is equipped with known GPS spoofing apps, app tampering tools, or app cloners, these are all indicators that the device may be used for fraud in the future.

Incognia’s Device Intelligence solution also makes it possible to detect whether a device has been factory reset.

Location intelligence can provide additional context that bolsters the risk assessment capabilities of a merchant fraud detection stack. Incognia’s Suspicious Locations feature identifies locations with a high concentration of risky devices, meaning devices that have previously been flagged for fraudulent activity or that have some of the risk factors mentioned above. Location intelligence can also be used as a passive address verification measure for verifying seller identity.

Because location intelligence and these device integrity checks are background processes, they can bolster a marketplace’s security without adding additional friction to the user experience, unlike other types of identity verification such as photo ID comparisons.

Just like their real-world counterparts, online marketplaces bring people who sell products together with the people who want to buy them. When everything flows smoothly, these are mutually beneficial relationships that also create profit for the marketplace platform.

But fraud and abuse interrupt the equilibrium of the marketplace and ruin the experience for good sellers and buyers.

Fortunately, there’s a path to safety and greater trust. By using resilient, user-friendly risk signals, marketplace administrators can detect seller fraud risk before it ever occurs and react accordingly.