- Blog

- What will the digital identity space look like in 2023?

What will the digital identity space look like in 2023?

Between the looming recession, new privacy regulations, and an ever-adapting fraudster ecosystem, 2023 has a lot of opportunities and challenges to offer the digital identity space.

Subscribe to Incognia’s content

Key TakeAways

- Stakeholders will be looking for ways to optimize and consolidate their ID solutions in 2023, focusing on how to cover the most users for the least cost

- The value of digital ID goes beyond fraud prevention—it’s key to promoting growth as well

- The widespread adoption of real-time payments could mean a big payday for fraudsters using social engineering scams, and regulators are questioning whether banks should have to foot the bill for swindled accountholders

The world stage is filled with promising developments and less-than-promising challenges heading into 2023. In the digital identity space, key players are making significant strides towards reducing fraud and establishing reliable, user-centric digital ID solutions. At the same time, new regulations and topical economic downturn mean that many companies in the space will be looking for places to make budget cuts and improve the performance of their business.

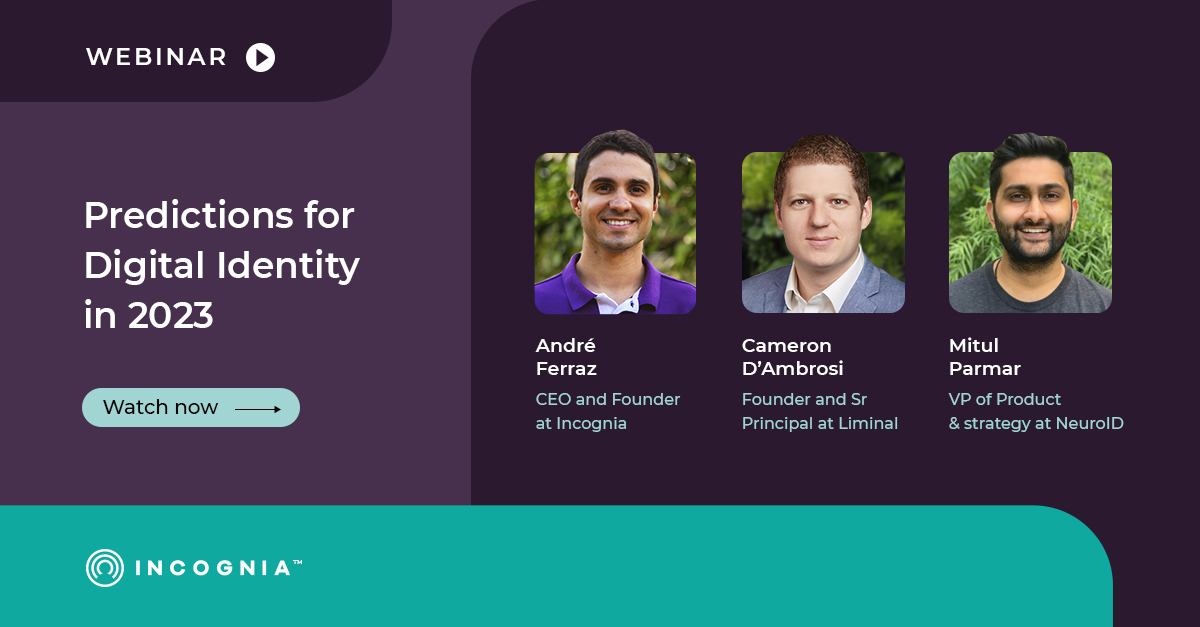

The digital identity world saw the beginnings of major tech layoffs back in late 2022, so it’s clear already that the industry has an ear to the ground financially. What other challenges and opportunities await the digital identity space in 2023? Andre Ferraz, CEO and co-founder at Incognia, Cameron D’Ambrosi, senior principal at Liminal, and Mitul Parmar, product strategy leader, give their most thought-about prediction for 2023 in this episode of the Trust & Safety Mavericks podcast.

Optimization, efficiency, and performance

When inflation rises and the economy heads toward recession, company leadership naturally begins looking for ways to optimize. In the digital identity space, this means more key decision makers asking questions about the value, cost, and efficiency of their digital identity solutions, both for fraud prevention and for promoting growth. As Mitul Parmar predicts, “You're going to hear a lot more scrutiny coming from the top to CIOs and asking them to take a look at their stacks and provide feedback to the CEO on exactly what they're paying for and what they're getting…You'll see more and more companies thinking about, ‘Is there a solution or a type of solution that I could put up front at the top of the funnel that can reduce costs downstream?’”

One of the major questions will be how to cover more users for less cost, and identity solutions that start working higher upstream in the customer journey will be particularly helpful in meeting the new focus on efficiency. Location intelligence and behavior analytics are among the digital ID solutions that are poised to make significant impacts at the top of the funnel. Parmar concludes, “I'm really excited to see what kind of progress and traction the top of funnel solutions get because they'll be in the spotlight as practitioners think about how to reduce costs downstream.”

Andre Ferraz also agreed that companies will be keeping an eye on optimizing their solutions’ performance this year. “There's going to be a shift in behavior in terms of what is considered when deciding which vendor to work with. I'd say performance optimization and fraud fighting are becoming more of a profit center than anything else.”

Understanding the value of digital identity solutions

In 2023, the idea of value is on everyone’s mind. This episode of the Trust & Safety Mavericks spends time focusing on the importance of understanding the value of digital identity solutions beyond their fraud fighting capabilities. As Cameron D’Ambrosi puts it, “When we're talking about how the modern consumer is transacting, we really feel that digital identity is the key to unlocking growth as well as addressing both compliance and risk issues, that you can have your cake and eat it too when it comes to delighting your good customers and frustrating bad actors.”

He also points out that it’s hard to quantify value in terms of potential fraud losses or compliance fines that don’t happen because the solution is already in place. Driving growth, however, is another area where digital identity solutions pull real weight. Coming from the digital ID vendor’s point of view, Mitul Parmar talks strategy for explaining the value of these solutions amid budget cuts: “I would definitely try and lean into how we may be helping out the onboarding teams and other cross functional organization pieces to show that we're more than just stopping fraud, we're actually key to our growth story. ”

Using location intelligence as an example, the solution may help stopping fraud by calling out transactions made from suspicious locations, but it also drives growth by providing a frictionless authentication experience for good users when it recognizes their trusted locations. The value of digital fraud solutions is two-fold, making it well-positioned for the coming conversations about performance and efficiency: it frustrates bad actors while encouraging retention among good users.

New fraud challenges taking center stage in 2023

Solutions providers have an eye toward their customers and key stakeholders as the economy shifts and circumstances change, but fraudsters are sure to keep adapting and upping their game in 2023.

Andre Ferraz predicts that social engineering scams will take center stage as real-time payment apps become more popular, with questions of liability pushing financial institutions to look for better upstream fraud prevention solutions. Cameron D’Ambrosi agrees, pointing out, “If banks are going to be responsible for an authorized user clicking the button because they were tricked, you're going to have to see a corresponding increase in the level of friction around those payments as banks look to protect themselves from those losses in particular.”

The digital identity landscape is sure to face some major changes in 2023, but those who come prepared have the best chance of making the most of new circumstances.

To hear the rest of our 2023 predictions, listen to the episode on Apple or Spotify or read the full transcript below.

This is an audio transcript of the Webinar: ‘Predictions for Digital Identity in 2023’.

You can watch the full webinar here, or listen to the podcast on Apple and Spotify.

Morgan Grandi

Andre, Cameron, and Mitul, thank you so much for joining us to share your digital identity predictions for 2023. I expect this conversation to be pretty dynamic given your various backgrounds. We have Andre, who is the co-founder and CEO of a digital identity startup called Incognia. Cameron is the founder and senior principal of a research and advisory firm focused on the digital identity ecosystem called Liminal. And Mitul is an experienced product strategy leader whomost recently spent time at Prove and Incode.

Before we kick off the discussion, I wanted to ask each of you if you could briefly introduce yourselves. And, Andre, if you don't mind, we'll start with you and then go around the room.

Andre Ferraz

Sounds good. Thanks, Morgan. Hi, everybody. I'm Andre Ferraz, CEO and co-founder at Incognia. I started my career as a security researcher. I have a computer science background, and Incognia is my second venture. Nice to meet you all.

Cameron D’Ambrosi

Fantastic. My name is Cameron D'Ambrosi, senior principal at Liminal Strategy Partners. As Morgan so kindly already introduced, we are a company that is really focused like a laser on digital identity in all of its applications, specifically the notion of the centrality of digital identity to everything and anything across verticals. When we're talking about how the modern consumer is transacting, we really feel that digital identity is the key to unlocking growth as well as addressing both compliance and risk issues, that you can have your cake and eat it too when it comes to delighting your good customers and frustrating bad actors. So thank you for the invitation and really excited to be here.

Mitul Parmar

Thanks for having me, Morgan. My name is Mitul Parmar. I've been in the identity space for the past couple of years. I'd say most recently, I've worked at Prove in a variety of roles. I was a director of product management, working on our emerging products, then led our product partnerships globally, and after that, ran corporate development for Prove. We were pretty active on the M&A front, so we've acquired several companies there. I think the most recent one was a company called UnifyID in the behavioral biometrics space. After Prove, I spent some time over at Incode running product strategy, product partnerships, as well as corp dev there. So thanks for having me.

Morgan Grandi

Great. Thank you all. All right, so Liminal, Cameron's company, actually lays out a very helpful framework for thinking about digital identity, and it establishes five core components of a digital identity. They include privacy, commerce, reputation, data protection, and inclusion. So, as we kick off the conversation about your predictions for the digital identity market in 2023, I think these components are really helpful in anchoring the discussion. Cameron, given that this framework has come out of your team at Liminal, is there any additional context you'd like to add?

Cameron D’Ambrosi

Yeah, thank you, and great intro. Again, I think this kind of speaks to some of my earlier comments, which is really we feel that identity for the longest time, I think has been a bit of a loaded word, right? It comes with a bunch of kind of cultural baggage. It means different things to different people in different contexts. And we really think that putting this framework together really helps us focus the lens on all of the myriad applications that digital identity necessarily must address to be successful. Trying to break down those silos or kind of open up this conversation, this notion that if you as an organization are thinking about digital identity in just any one of these areas without its impact on the others, you're opening up some negative externalities for yourself.

Again, whether that's on the fraud and risk side or whether that's on the regulatory risk side or whether that's on the growth and inclusion side of the ledger. And that forward looking organizations are really taking a holistic approach to digital identity. And that we feel that right now, in many ways it's a competitive differentiator, but that tide continues to rise and many of these things we feel, are going to be table stakes to remain competitive. Not just a nice to have, but a must have. So excited to jump into these predictions for '23.

Morgan Grandi

Awesome. And Cameron, if you don't mind, will you kick us off? Within these categories, what is your top prediction for digital identity in 2023?

Cameron D’Ambrosi

Great question, and it's a bit of a broad one, but I think this notion of the regulatory elements of digital identity are really going to continue coming to the fore in 2023. We have seen a continued rising tide over the past years with regulations like GDPR, like CCPA. That march is only going to continue onward. And I think we're seeing a new layer of considerations around identity, particularly this notion of age, that is really going to fundamentally shift how platforms are going to be forced to think about how they are marketing to users, how they're bringing users through the funnel, and how they're paying attention to what users are doing on their platform.

California in some ways has led the way. The UK has also been making a big push here, and we're expecting to see jurisdictions across the globe really start thinking about continuing to tighten these regulatory constraints around how and why data is collected about users and what obligations you have, for lack of a better word, around how users are treated within your platform and what those users can ultimately do. A lot to unpack there, but I think that's a good marker to lay down that if you are not proactively thinking about these elements from that regulatory lens, you're going to be caught on the back foot.

Again, this is going to carry over into so many other elements like how you manage your user experience from a growth perspective as well.

Morgan Grandi

I heard you mention also the issue of age verification, which I think is, is a really interesting point and, and one thing to watch coming up in 2023, especially with delivery exploding and even moving into alcohol delivery. Great point there. Andre, Mitul, any thoughts on your top predictions?

Mitul Parmar

Yeah, I can take a shot at this. I'd say my top prediction—and we're talking 2023, so I'll just call out the elephant in the room—people have less money to spend if you're a company in 2023. I think you're going to see a period of vendor consolidation as well as optimization. I'd say if I'm a practitioner, the first thing I'm looking to do is to optimize. First, you're going to hear more questions coming from the top about what am I really getting by implementing this vendor or the solution? Is this really driving fraud reduction? Is it driving potentially anything on the revenue side? Is it driving user acquisition?

You're going to hear a lot more scrutiny coming from the top to CIOs and asking them to take a look at their stacks and provide feedback to the CEO on exactly what they're paying for and what they're getting. And I think what you'll see happen is the optimization angle would be huge. You'll see more and more companies thinking about, “Is there a solution or a type of solution that I could put up front at the top of the funnel that can reduce costs downstream?”

Obviously, Incognia is a good example. If you see that someone's location is totally not what it's supposed to be and it's not from a location that you would consider, let's say, a trusted location and they've never transacted from this location before. Now that's going to lead to a different downstream flow in how you address potential fraud. You may ask for an identity verification if they're doing a $50,000 transaction from a location they've never been in before, well, you may say, okay, we want to see proof. Maybe we want to see an ID document. Maybe you need to do a facial recognition segment. You'll see more and more optimization.

I think the most interesting vendors for me this coming year will be the ones that are at the top of the funnel that are really impacting your fraud costs and friction downstream. Obviously, location intelligence is one. Behavioral analytics is as well. The Neuro-IDs of the world, if you're examining folks that are already within your four walls, so you're thinking about ATL, there's the BioCatchers of the world. But I'm really excited to see what kind of progress and traction the top of funnel solutions get because they'll be in the spotlight as practitioners think about how to reduce costs downstream.

Morgan Grandi

Thanks, Mitul. I can't think of a better transition to Andre.

Andre Ferraz

Yeah, that was great. I actually brought something very similar so I totally agree that optimization is going to be a big theme as we get into this looming recession. I predict that one other thing that will occur more from a structural standpoint is that the people that are responsible for digital identity and its implementations will stop being just the type of people that are trying to comply with the regulations, let's say like KYC regulations, et cetera, and trying to focus on bringing as many people inside as possible to actually focusing their attention on efficiency and understanding.

If I'm really putting the good users in, or if I'm letting the fraudsters pass as well. I think performance is going to be a big theme for 2023. There's going to be a shift in behavior in terms of what is considered when deciding which vendor to work with. I'd say performance optimization and fraud fighting becoming more of a profit center than anything else.

Cameron D’Ambrosi

Yeah, just to piggyback on both those points, I think when you look back historically to the last recessionary cycle we were in, we saw organizations take kind of a sledgehammer approach, executives going to kind of all the teams within their organization and saying we need to take X amount of heads, X amount of budget off the top. We saw fraudsters in particular have a field day with that because in some ways fraud is countercyclical. You have more people maybe interested in doing various types of fraud, especially friendly fraud, as their household budgets tighten, for example. You would see many times the potential budget savings of cutting back on these fraud teams paid out or lost in those corresponding fraud losses. And then, all of a sudden, executives going, “Wow, actually this is costing us more money than we saved,” and retrench.

I'm hopeful that we'll see some of those lessons learned and internalized from that last downturn taken to heart as we head into this new recessionary environment and that executives will maybe think twice about taking 20% off the top when there are corresponding fraud losses that are going to eat into some of those apparent savings.

Mitul Parmar

How do you think if you're a practitioner, Cameron, how do you think about playing some defense so your budget isn't totally slashed? The first thing that comes to mind for me is we're trying to find a correlation between what my team does on the identity side to how we're actually helping bring more users onto the platform. We're bringing higher quality users onto the platform. If I'm downstream and I'm hearing the news from up top that budgets are being cut, I think one of the angles that I would try and lean on is that, well, we're doing identity really well and fraud reduction is just a byproduct of that.

It's not like you can just cut fraud tooling budget. But doing identity well also leads to greater conversion and higher retention of the right type of users. I think companies in the space have started leaning into that and are rolling out products that capture that. Obviously I'm a bit biased having worked at Prove, but the prefill product that Prove has, which helps onboard users faster, but it's in a more secure way, that's an example of both fraud reduction, but also faster onboarding for end users. If I'm a practitioner, I think I'm definitely spending time thinking about, okay, well, I'm not just cutting these fraud losses, right? Oftentimes teams don't even know how much they're saving the firm in fraud losses. That's the first thing I'd probably get a handle on in terms of what is the impact of my team's work on the fraud side.

But then I would definitely try and lean into how we may be helping out the onboarding teams and other cross functional organization pieces to show that we're more than just stopping fraud, we're actually key to our growth story.

Cameron D’Ambrosi

No, 100%. And I think that historically has been the challenge for vendors that to some degree have maybe been pigeonholed into more of that fraud and risk and compliance space It's pretty hard in a meeting to prove a negative to say, well, we spent X on fraud prevention, we spent X on compliance, but we saved Y in theoretical fraud losses that didn't occur, we didn't get fined for these reasons. It's hard to make that argument. I think one of the things we have always been talking about here at Liminal is encouraging vendors to have conversations with as many stakeholders as possible across the business, hopefully kind of diversify the stakeholders that you are interfacing with and tell not just that fraud narrative, but also that growth narrative.

The notion that a good and streamlined user experience is paying dividends on that growth side, not just in frustrating bad actors, but also delighting those good actors, hopefully allowing you to carve low friction onboarding experiences into your flows that are bringing those good customers in, keeping the conversion rates high, right? Attracting new customers is fundamentally expensive. It's in many ways much more expensive than it is to retain an existing customer. So how can we be using these tools to bring as many good new customers through the funnel as well as keeping the user experience low friction for those existing good customers?

Not opening up new fraud vectors for threats like ATO, but at the same time allowing those existing customers that you already spent good money to attract and bring onto the platform, enabling them to transact quickly. Not throwing a bunch of, for example, login friction, risk based transaction friction in their face when they're trying to do things like buy a $4,000 TV at two in the morning. That could be a fraudster. That could also be like one of your best customers who is making a high dollar purchase at a time that just happens to be random.

The last thing you want to do is frustrate that person when they're trying to spend a bunch of money with your platform.

Morgan Grandi

Mitul, I was going to ask you about your predictions for specific trends or rapid growth on the solution side, but you pretty much covered that. Are there any additional recommendations for teams considering retooling their identity and fraud stack in 2023?

Mitul Parmar

Yeah, I think going back to what I said, retooling can be hard. If you're thinking about like, hey, I'm going to plug out a piece and replace it with a cheaper piece, I think that can be challenging. Let's say you want to totally switch your ID verification provider and the bulk of what they're doing is scanning a document and they're scanning your face and making sure those things tie. That's a pretty important piece and you're probably rolling it out just on the high risk customers or depending on the use case, you may be rolling that out to every user.

But I think I would consider is there something I can add to the top of the stack that can just greatly reduce my usage downstream without like, ripping and replacing things downstream? Because that involves searching for new vendors, that involves testing and it's just a ton of work on the development engineering side as well as the search itself. Oftentimes I would recommend, like, is there something you put up front that will then just lead to lower usage downstream? You can keep the vendors you have below if it makes sense, but you can reduce the amount of volume that goes to those vendors by having something smarter upstream. It's almost like subtraction by addition upfront.

Andre Ferraz

Totally agree on the upstream part. And another prediction I have for 2023 is regarding social engineering scams. I think they'll continue to increase and driven by two main things. First one being just the recession itself. As we were mentioning here, some people will probably pivot on their careers, start trying to make some money on the other side. We might see an increase in volumes overall just because people would try to make money in different ways.

But the other is more related to the acceleration of instant payment adoption. We're starting to see a lot of that with Zelle right now. There was recent news this week on the Wall Street Journal about a few credit unions that were considering stopping to use Zelle because they weren't being able to reimburse their customers. That's an example of it.

In 2023, we'll also see the implementation of FedNow, which is supposed to be open to everybody and all the financial institutions. The adoption may be greater than Zelle at this point, depending obviously on the user experience that will be offered. But this could be a big driver of social engineering scams, which may put additional pressure on, especially financial institutions in regards to reimbursing customers that are scammed. And we're probably going to see legislation around shifting the liability towards the financial institutions. And that might also be a forcing function to retool and to implement more optimized tools, especially upstream, so they can cover more users with less cost.

Mitul Parmar

Yeah, I've got another prediction on the side of the identity players. Not exactly what the customers of our ecosystem will do, but when you look at the identity landscape, it's always been fragmented. We've been saying that for years. And I think this will finally be the year where you see prices for companies come down to earth and you'll see larger identity players think opportunistically about buying up smaller companies. And I think the M and A will probably fall into a couple of buckets. The first will be companies that are smaller, still growing fast, but not fast enough to grow into the last valuation. They raised that.

So if you raise like, $20 million to get to a half billion dollar valuation or something, and you just need to grow into that valuation, well, you've got a pretty short runway, right? If you're looking at $20 million, call it 100 employees, that's a lot of growth that you need to execute on with a little bit of money. So you'll see larger companies look for fallen angels, which were companies that had raised at way too high of a valuation, but they're still growing quickly. They're not defunct companies or companies with bad prospects. It's just the math doesn't add up in this new world. So you'll see larger players opportunistically buy those.

I think there'll also be more plays for international growth. The largest players are continuing to face pressure to grow. It's extremely challenging to start a company in the US and be successful in Europe and in other geographies. But you'll see larger players look for tuck in acquisitions that will help them access international markets or grow in regions which they don't have products in.

And I think the last challenge that companies will face, and it's not necessarily M and A, but I think the largest companies will continue to face a ton of pressure from their investors to become platforms. Those that have raised a ton of money that are already beyond, like, a billion dollar valuations. Beyond a billion dollar valuation, I think you're going to see more and more pressure for them to add on more and more products to keep their TAM growing, to continue with the increase, with increases in revenue, to scale their growth rates. And I think that's going to be a challenge. I don't know if some of the larger companies that have raised a ton of money will be able to raise at the same valuation. I think some of them will have to mark down their equity or take down rounds, and that may also lead to a shift in talent.

I think it's possible like folks that have gotten really strong, employees that have gotten equity marked at too high of a price. You'll see a bit of a flight to talent, potentially to smaller companies, which is always good to see experienced folks from larger companies move to smaller companies to scale those. I think it's going to be a mix of things, but I am interested in terms of just the overall market impacting, valuations in M and A.

Cameron D’Ambrosi

Couldn't agree more. To piggyback, Andre, on your comments around real time payments. The shift to RTPs, to your point around social engineering, is really going to put a lot of pressure on digital identity stacks in particular. Why did the payment rails evolve as they have? Why was T plus three the norm? Quite frankly, it's not because we didn't have the technology to settle quicker than that. It's because everybody enjoyed a built in buffer in order to go back and hit undo, because we had three days to kind of really make sure that this money is going where we want it to go and that everything is in order.

When you move to a true—nothing is truly real time—but when you move to same day settlement of these transactions, it is going to put a lot of pressure on making sure that that payment is right, that it's going to the right person. And these changes around Reg E, I think, are going to be a really interesting area of pressure.

What constitutes fraud? We've seen right now with platforms like Zelle, if you are socially engineered into clicking the button yourself as the authorized user, most banks right now are saying, well, that is not an unauthorized transfer as per the letter of the law. You authorized this, you were the right person, we're not going to reimburse you. I think it's going to be a really interesting element that underpins this transformation is what will constitute the definition of an unauthorized payment. Will social engineering kind of be eligible for reimbursement?

And I think the friction that we're going to see in these flows is going to be directly impacted by that. Because if banks are going to be responsible for an authorized user clicking the button because they were tricked, you're going to have to see a corresponding increase in the level of friction around those payments as banks look to protect themselves from those losses in particular.

Mitul Parmar

Cameron, I've got a question on what you're seeing out there. My personal belief is I think you're going to see fraud and identity companies lean into payments, meaning fraud and identity companies say, “Well, the payments folks are struggling with fraud, but we're far better at fraud, and adding on payments capabilities will be, in our view, more commoditized.”

And this is a naive view, having not worked much in payments, but I think there'll be bold moves by fraud and identity companies like Sardine, who started moving money. But I think you'll see others follow suit and say, “We're great at fraud and risk, so let us move the money for you. We'll take on that risk.”

That's one area where I'm curious if you're seeing any of that. That is a prediction from me. I think folks are looking at Sardine and saying, that is definitely an angle to continue scaling your company to bigger TAMs and moving into payments is an adjacency that makes sense.

Cameron D’Ambrosi

100%. I think that's spot on, whether it's instant, whether it's Sardine, we kind of saw pioneers of this notion in the chargeback space, moving from a pure scoring based product to a more insurance type model where it's “Pay us basis points on a transaction and we will fully guarantee it.” I think you are going to see the platforms that necessarily don't think they can afford building out a truly sophisticated stack inhouse because they don't have the expertise, they don't have the money, they don't have the time and budget to do so, looking to the vendor space for that protection.

And I think that model, a la Sardine, who you called out, is really going to see adoption because of the fact that taking that network approach and building really tight integration around the identity stack into the payments layer is going to be how folks kind of fundamentally solve this challenge.

Mitul Parmar

Yeah, and I think the last thing I'd add is it's contextual, right? Like the fraud risks for a credit card vary from what you see with ACH and other types of payments methods. I actually think fraud and identity companies do have an advantage when they think about moving into payments versus the other way around.

Cameron D’Ambrosi

If you were on the floor of Money2020 this year, I was fond of saying payments has basically become identity fundamentally, right? We've known how to move money for a long time. It's the identity layer that's been the challenge. Money2020 was a very identity-centric show this year. I don't think that's a fluke. I think that is portending these shifts that you're calling out in particular, increasingly tight integration.

And shameless plug alert, look for the update to the 2023 Liminal Digital Identity Landscape coming early next year, where we're going to be calling out some of those changes as we see them inside this market space on that honeycomb landscape.

Mitul Parmar

I'm not necessarily claiming that fraud and identity companies are going to all get into moving money. Some will, that have the resources to move into that and the expertise. But there will also be fraud and identity companies that are far enough in the transaction, far enough up in the stack in the transaction that they'll be able to say, we know who the user is. And I think identity in a transaction precedes payment, right? You first figure out who it is before you ever get to check out.

If you're like, approved and you can identify who the user is based on their cellular connection, or if you're any of these companies that sit top of funnel, you have an ability to influence the payment method downstream, right before you even get to the checkout wars, where all the BNPL, PayPals of the world are fighting for mind share and wallet share.

If you're an identity company and you're seeing who the user is before they get to checkout, I think there's some power in that. And if you're at any of those companies, you should be thinking about like, well, how could I use this to apply some leverage or influence over what direction this user goes from a payment standpoint and how could I possibly generate revenue off of that?

Cameron D’Ambrosi

Couldn't agree more.

Morgan Grandi

Great points. Well, thank you. We are at the thirty minute mark. I want to thank you all so much for joining us for this discussion and hope you have a great year to come. We'll be looking closely at which one of these predictions seem to be coming to fruition. Thanks so much, Mitul, Cameron, and Andre.

Cameron D’Ambrosi

It's my pleasure.

Mitul Parmar

Thanks everyone.