- Newsroom

- Incognia’s Device Identity Frontline Report Finds Nearly 39MM Devices Downloaded Apps from Suspicious Sources

Incognia’s Device Identity Frontline Report Finds Nearly 39MM Devices Downloaded Apps from Suspicious Sources

Leader in location identity releases new findings on fraud and identity, predictions for 2024

Subscribe to Incognia’s content

San Jose, CA – March 20, 2024 - Today, Incognia, the innovator in location identity solutions, is releasing findings from the new Device Identity Frontline Report, which details insights into top security issues, along with threats on the horizon for the year ahead. In 2023, Incognia analyzed 270MM devices and returned 3.74B risk assessments for events like account creation, login, and transactions worldwide. The report shares insights drawn from that analysis, including the fact that 38.5MM devices downloaded apps from suspicious sources, while nearly 2.5MM devices were engaged in app tampering–the process of manipulating a mobile app in various ways. This can range from changing the name of the app's publisher and package name to cloning the app and changing the source code in order to bypass security measures. Incognia found that across all assessments, 6.5% came back as a high risk for fraud, making cross-device fingerprinting a must-have tool in the fraud fighter’s arsenal.

“FTC's latest Consumer Sentinel report showed consumers lost a record $10 billion to fraud in 2023, with the median loss for all reports being $500. They reached the highest numbers in bank and payment-related categories, with an average of nearly $8,000, so it is critical for companies to address this issue and protect their customers,” said André Ferraz, co-founder and CEO of Incognia. “Last year, Incognia prevented more than 22MM potential account takeovers (ATO) and 1.6MM potential mule accounts, accounts that help fraudsters process fraudulent funds. Our unique approach to fraud prevention combines tamper-resistant device fingerprinting and exact location data to recognize users across multiple devices and locations, allowing us to address the most sophisticated security challenges. This report sheds light on the changing face of fraud and how companies can get ahead of it to defend themselves and their customers.”

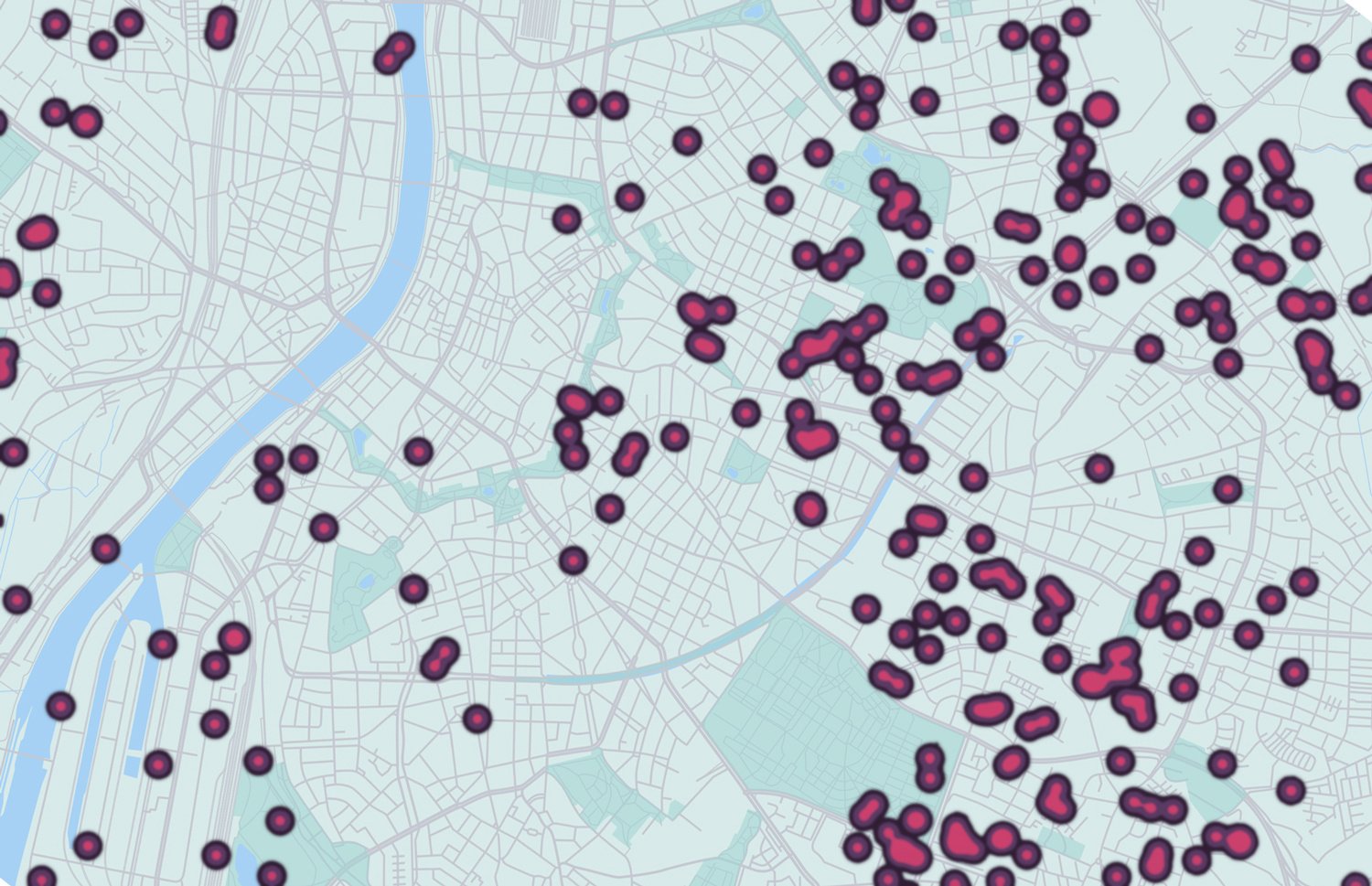

With Incognia’s next-generation identity signal as the first step in fraud prevention, authentication, and user verification flows, companies can significantly reduce fraud, false positives, and operational costs while confidently giving legitimate users a frictionless experience. Incognia’s apartment-level precision helps assess the trustworthiness of a transaction and identify fraudulent activity. Moreover, even if a fraudster tries to spoof their location to avoid detection, Incognia’s advanced location spoofing detection is able to flag that user as high risk.

In order to help companies get ahead of new fraudster tactics, Incognia compiled its top three three fraud trends to watch for in 2024:

- Using app tampering to bypass biometric validation: Fraudsters may use tampering techniques to bypass an app’s attempt to collect biometric data or other types of data. When used on other people's accounts, this could enable ATO attacks, especially with the rising popularity of deepfake attacks that leverage generative AI. Alternatively, deepfakes are most commonly used to create fake accounts.

- Ghost hand attacks: Part social engineering, part remote access, ghost hand attacks involve a fraudster pretending to be a bank representative calling a bank customer to trick them into installing malware on their device. This allows the fraudster to remotely access their device and steal their real banking app credentials. Once they have access to the victim's digital pockets, they can transfer funds and perform other fraudulent actions before disappearing.

- Virtualization: What used to require a desktop emulator, a tool that enables developers to test a specific feature that hasn’t been deployed yet, is now available via smartphones and accessible to a broader audience. As a result, fraudsters can use these emulators to tamper with an app, change attributes, and, ultimately, commit fraud by running it through a synthetic environment.

The new report follows Incognia’s Series B funding and notable company momentum, including tripling revenue, realizing 200% net revenue retention, and converting 100% of trials.

Incognia serves companies across financial services, marketplaces, e-commerce, and the gig economy, such as food delivery and ride-hailing platforms. For more information about the company’s unique approach and to view the full report, including strategies for preventing fraud in 2024, visit https://www.incognia.com.

About Incognia

Incognia is the innovator in location identity solutions that deliver cutting-edge user verification and account security across the digital journey. Leveraging over a decade of expertise in location technology, Incognia's novel approach enables frictionless experiences using device intelligence and the most precise location data available. Incognia enables customizable risk analysis and actionable insights from day one that empower consumer businesses to prevent fraud, protect users and build customer trust. For more information, visit https://www.incognia.com/.

###

Media Contact:

Aimée Eichelberger

aimee@superior.com