The Solution

The Fintech implemented Incognia's Zero-Factor Authentication solution into the user authentication flow, protecting the user's journey at login and securing other sensitive transactions performed in the application. Incognia provides a risk assessment based on location behavior, device intelligence, watchlists and the analysis of network environments.

-

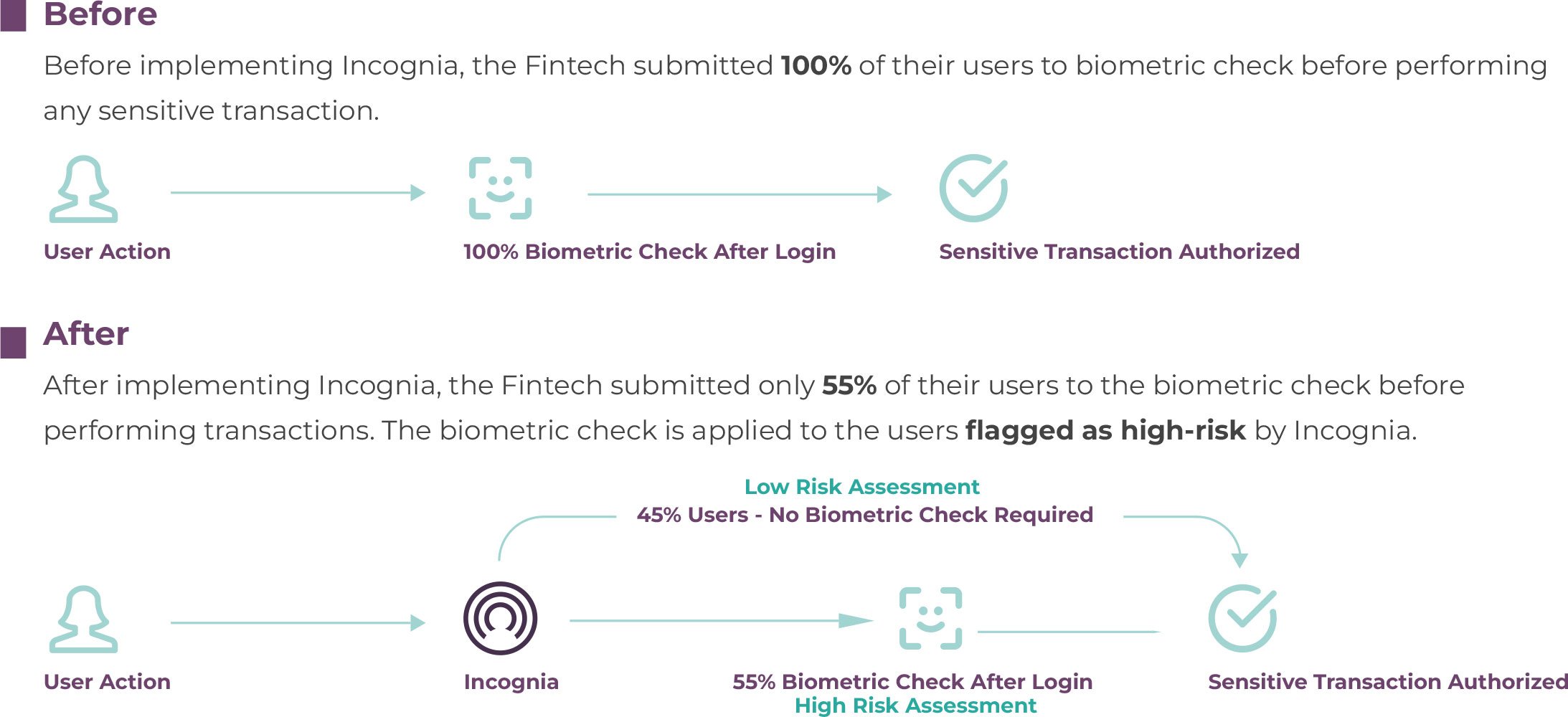

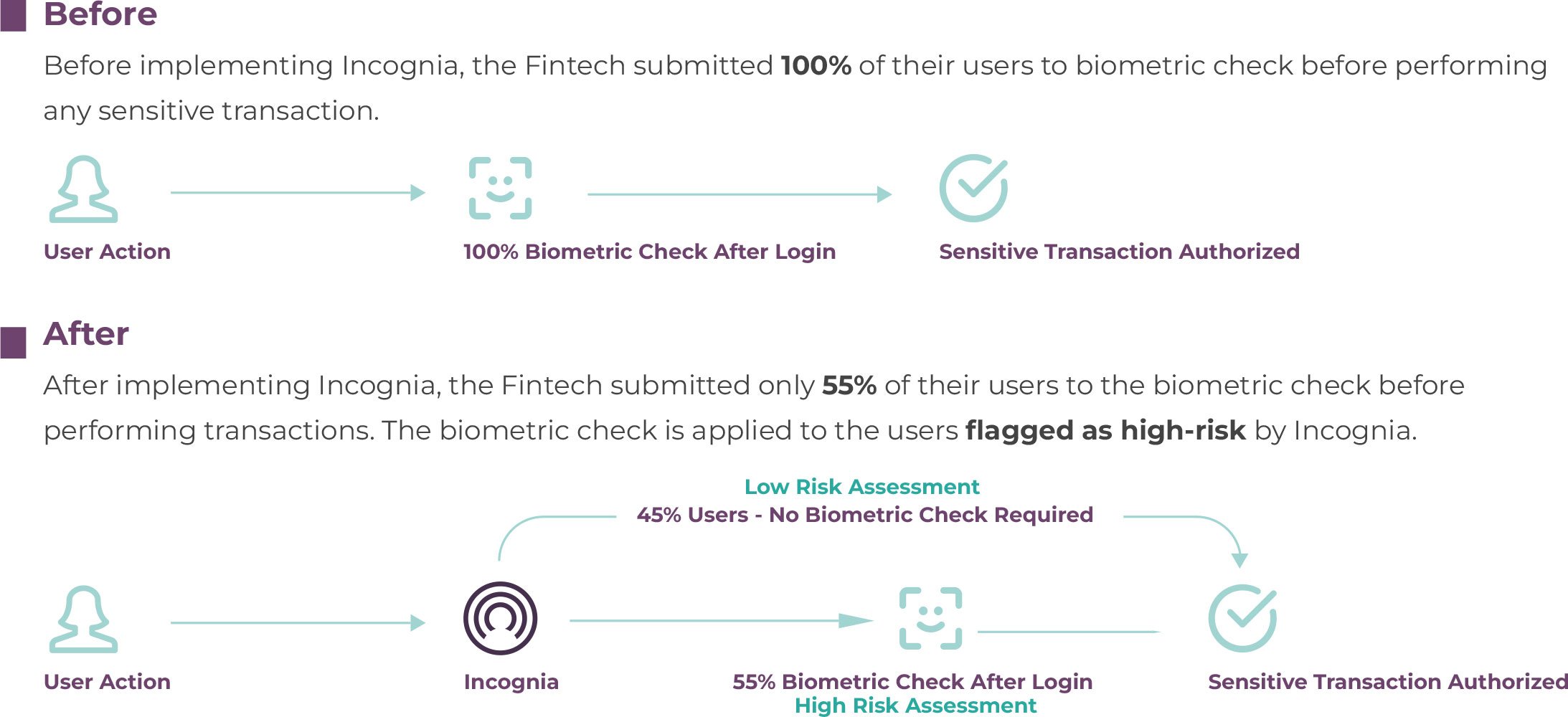

Each time Incognia provides a “LOW” risk assessment, the Biometric authentication step is skipped and users can access their accounts in a frictionless manner.

-

When incognia provides a “HIGH” risk assessment, then a Biometric authentication step is triggered so that higher friction is only reserved to higher risk cases.

With this authentication flow, legitimate users are able to enjoy a simple login process covering the majority of consumer profiles. At the same time the Fintech achieved cost savings by only using biometric authentication for high-risk cases.

How Incognia works

Whenever a user tries to access their Fintech account, the Incognia SDK, integrated into the Fintech app, has access to location and device intelligence data from that device. This is possible because of Incognia proprietary location technology, which combines location sensors and device intelligence to build a persistent fingerprint associated with the user. Each user has a unique location behavior, and this pattern is constantly updated by Incognia, like a dynamic identifier, that is extremely difficult to forge and therefore resilient to spoofing. To validate transactions or authenticate the user, Incognia verifies, in the background, the location behavior of that user, composed of trusted locations, to distinguish legitimate user from fraudsters in real time and prevent account theft. Incognia's statistics show that 90% of user logins,and 95% of sensitive transactions occur from trusted locations. In this sense, you can check the trusted locations associated with the device to ensure its security and avoid adding friction.

Applying Incognia in a waterfall, before the Biometric solution in the customer journey, the Fintech was able to reduce by 51% the cost of their authentication flow.

“The main strategies involved in the implementation of the solution were to improve our in-app security, reduce costs for low-risk biometric requests, and provide a better experience to our customers. One of the aspects that differentiates this project is the support we had from the Incognia team. We have weekly meetings to discuss results, best practices around strategy, and opportunities for improvement”

W. M. - Head of Fraud Prevention and Authorization @ Fintech